Top 10 Home Decor Trends for 2026

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed do eiusmod tempor incididunt ut labore...

Read Article

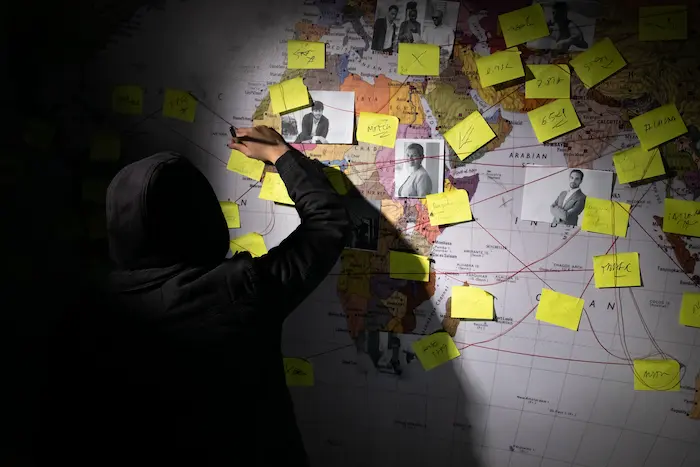

Operating in the Intelligence industry for over 18 years, we bridge the gap between suspicion and factual evidence.

What makes TrackEye different is our dual expertise in Intelligence and Security services. Our team of experienced investigators follows a strictly prescribed protocol to ensure all intel reaches you on time, in an ethical manner, and without any tampering.

TrackEye's investigative breakthroughs have been consistently featured by leading national publications.

We don't just investigate; we protect your peace of mind with discretion and precision.

Worried about privacy? Rest assured, your identity remains undisclosed in all circumstances. Our expertise in discreet investigations makes us the trusted choice for clients seeking truth without risks.

Unlike many agencies, we do not require excessive details to start. We minimize inaccuracies and ensure the authenticity of our mission, delivering 100% result-oriented strategies every time.

TrackEye stands among the best agencies offering premium investigation services at competitive prices. We prioritize client satisfaction, ensuring top-notch service that fits your budget.

Whether investigating an employee, spouse, or partner, TrackEye is your reliable partner. Trust us to uncover the truth with integrity, professionalism, and complete confidentiality.

Select a category below to explore our specialized solutions.

Get hold of facts: Our team is highly sensitive to the urgency of personal relationships. We thoroughly examine crucial areas such as age, education, moral character, criminal clearance, and business details to uncover the truth.

Inclined to your satisfaction: We conduct investigations with complete confidentiality. Our goal is to help clients obtain solid evidence (photos, videos, audio) to make informed decisions regarding marital discord.

What We Master: We specialize in gathering evidence for assets, behavior, and child custody. Whether ending a relationship with a cheating partner or fighting for rights, TrackEye provides concrete court-admissible evidence.

We understand the sensitivity of love affairs and extra-marital investigations. Our team conducts complete shadowing and surveillance of the partner, reporting any suspicious activity with discretion.

Clear All Your Doubts: Skilled in both stationary and mobile surveillance. Whether for individual or corporate clients, we provide a well-compiled report including logs and visual proof at the end of the investigation.

We Make The Search Easy: Experienced in locating missing family members or debtors. Regardless of whether the person is missing willingly or due to external factors, we gather evidence to begin the search promptly.

Reduce the risk of fraud by bringing fraudulent parties to justice. Services include Employee Background Checks, Skip Tracing, Due Diligence, Surveillance, and resolving Labor Court cases.

Designed to assist whether you are hiring or have hired. We thoroughly check credentials, previous employment, references, and character evaluations to ensure the candidate is the right fit.

Protecting your brand is crucial. We investigate counterfeit products and supply chains. We conduct thorough raids and take legal action against those involved in infringing your Intellectual Property.

When accusations of employee theft, fraud, or misconduct arise, it is crucial to enlist a competent team. We gather irrefutable evidence and provide comprehensive reports for legal or internal action.

We conduct confidential tracing of absconding debtors to help you recover assets. Our approach centers on gathering location intel and providing ample evidence for you to take appropriate legal action.

Designed to help banks prevent fraud. We thoroughly examine claims to verify authenticity. Trust us to help protect your assets and ensure the financial integrity of your business verification processes.

Years Experience

Cases Solved

Success Rate

Cities Covered

TrackEye functions as a trusted and licensed private detective agency in Delhi, providing expert investigative solutions to both individuals and businesses. We operate with a team of elite experts, including former police officers and intelligence professionals, ensuring precise and lawful case handling.

With years of experience, TrackEye stands as the best detective agency in Delhi NCR. We specialize in surveillance, forensic & cyber intelligence, legal corporate probes, and personal dispute resolutions.

Our evidence-backed reports ensure clients make confident, informed decisions based on trust, precision, and professional investigation.

We uphold absolute confidentiality and integrity in every investigation. Committed to ethical standards, we deliver truthful, unbiased reports backed by factual evidence.

Our professional conduct ensures each case is handled with discretion, accuracy, and unwavering dedication.

We don't just investigate; we provide peace of mind. Here is what our clients say about our discretion and results.

From complex corporate litigation to sensitive personal matters, TrackEye provides the evidence you need with unparalleled discretion and 18+ years of expertise.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed do eiusmod tempor incididunt ut labore...

Read Article

Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo con...

Read Article

Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatu...

Read ArticleWe are available 24/7 to assist you. Please fill out the form below or call us directly. All communications are strictly confidential.